As many strip-tillers can attest, finding the right mix of equipment to maximize performance and productivity in the field is an evolving process. It may takes years or even decades of experimentation with different toolbars, row units and attachments to find the right combination.

This notion is reinforced by responses to the equipment usage portion of the 3rd annual Strip-Till Benchmark Operational Study, which revealed a variety of brands, row unit setups and sizes of unit used by farmers.

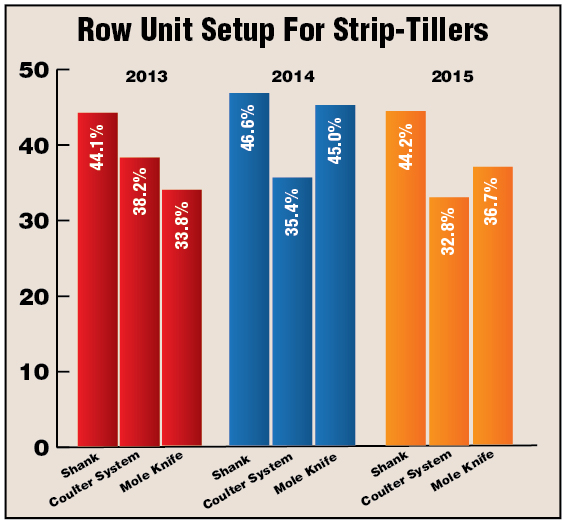

For the third straight year, a shank-style setup proved to be the most popular among strip-tillers, with 44.2% using this system, down slightly from the 46.6% in 2014 and similar to the 44.1% in 2013.

Second-most popular was a mole knife at 36.7%, but this represented a nearly 10% decline from the 2014 total of 45%, and closer to the 33.8% in the 2013. Rounding out the list for the third year in a row and continuing a downward trend was a coulter system with 32.8% using this setup, compared to 35.4% in 2014 and 38.2% in 2013.

Seasonal Strip-Tilling

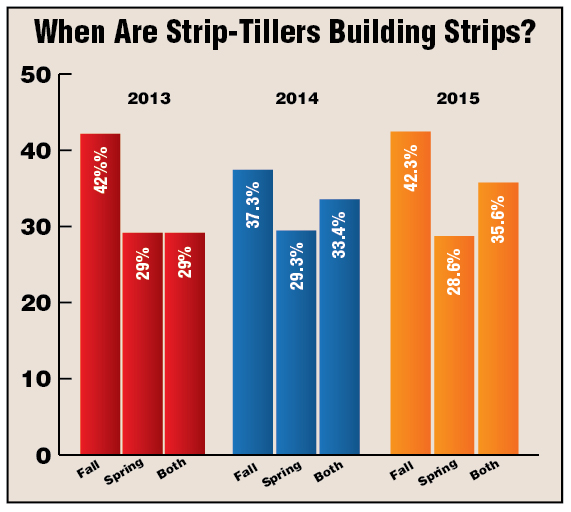

The type of row unit setup strip-tillers find most effective can depend on field conditions and when they prefer to prepare their seedbed. Fall strip-till proved to be the most popular timing for the third year in a row, with 42.3% of farmers getting back into the field after harvest. While this represented an increase over 2014’s total of 37.3%, it’s on par with the 42% reported for 2013.

An increasing percentage of farmers are strip-tilling in fall and spring, perhaps for a refreshing pass or having adaptable equipment setups to accommodate either season. Some 35.6% respondents to this year’s benchmark study are fall and spring strip-tillers, up from last year’s 33.4% and the 29% reported in 2014.

The smallest percentage of respondents spring strip-till, with 28.6% preferring this timing, down slightly from 29.3% in 2014 and 29% in 2013.

Upsizing Equipment

With strip-till acreage on the rise, it makes sense that farmers are increasing the size of their equipment to cover more ground in a shorter amount of time. While 44.4% of farmers utilized a 12-row strip-till rig on their operation in 2015 — by far the most popular size — 37.5% used 16- or 24-row machines, an increase over prior years.

This year’s study showed that 31.7% of strip-tillers used a 16-row rig, up from 28.7% in 2014 and 25.7% in 2013. Those farmers running 24-row strip-till rigs also continued to climb to 5.8% in 2015 study, compared to 5.4% in 2014 and 4.3% in 2013.

Given that more farmers are pulling larger strip-till rigs, it made sense that tractor horsepower continued to increase. Farmers averaged 325 horsepower to pull their strip-till rigs, compared to 310 in 2014 and 278 in 2013.

On the other end of the spectrum, only 18.2% of respondents used 8- or 6-row strip-till rigs. This continued a downward trend for use of smaller rigs, with 7.7% running 6-row strip-till machines, vs. 7.6% in 2014 and 15.7% in 2013.

Farmers using 8-row rigs also declined to 10.5%, from 12.4% in 2014 and 11.4% the prior year.

Brand Recognition

It’s common to see farmers tinker, tweak and even take apart strip-till rigs in an effort to improve performance or adaptability to their field conditions. With no shortage of field-ready machines on the market, strip-tillers have a variety of options to choose from — at least for a starting point.

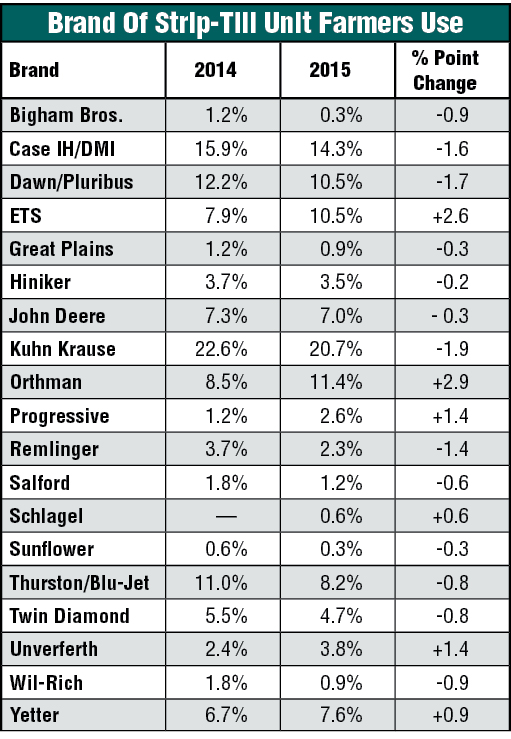

For the second year in a row Kuhn Krause was the most commonly used strip-till rig, with 20.7% of respondents using the manufacturer’s machine, despite about a 2% year-over-year dip.

Ranking second again was Case IH/DMI, with 14.3%, down slightly from 15.9% in 2014, followed by Orthman, which jumped to third (11.4%) from fifth (8.5%). Dawn Equipment Co. ranked fourth (10.5%), down one spot from 2014 (12.2%), and tied with Environmental Tillage Systems, which ranked sixth (7.9%) in 2014. Rounding out the top 5 were Thurston/Blu-Jet at 8.2%, down from 11%, according to last year’s study.

Looking at brand usage, only 36.8% of strip-till manufacturers saw year-over-year growth, compared to 57.9% in last year’s study. Given the ag market, it’s possible that strip-tillers were more conservative with purchasing new toolbars, row units or attachments in 2015 and it will be interesting to see if the trend continues this year.

The Top 10%

So how do the equipment setups of the highest-yielding strip-tillers compare to the overall group? The majority of the top 10% utilized a shank setup on their row units, with 59.4% preferring this system, followed by mole knives (32.3%) and then a coulter system (25%).

This deviated from last year’s results, where 34.1% preferred a mole knife, 27.3% used a shank-style setup, and less than 1% used only a coulter system on their row units, or a combination of coulters and shanks.

Looking at the size of strip-till rigs, 62.5% of the highest-yielding strip-tillers ran 12-row machines — about 20% more than the overall group — but close to last year’s 61.4%. The number running 16-row units, 31.3% was nearly identical to the larger group, but up from 2014’s total of 25%. Only 2 of the top strip-tillers ran 8-row rigs, and none ran 6- or 24-row machines according to this year’s study.

As for which brand of rig the highest yielding strip-tillers preferred, 25% ran Orthman units, up about 10% from last year. Last year’s top brand, Kuhn Krause was second with 21.9%, down from 22.7% and Thurston/Blu-Jet was third with 12.5%.