Advertise Follow Us

Shifts in Row Unit Size, Setup & Timing of Strip-Building

Greater percentage of strip-tillers ran 8-row units, preferred shank-style setups while far fewer spring strip-tilled in 2017.

Flexibility is a luxury strip-tillers often speak of with their system. The ability to adapt row-unit setups to suit field conditions, and even shift the timing of strip-building to accommodate for Mother Nature’s unpredictability, can pay big dividends for strip-tillers.

The 2018 Strip-Till Operational Practices Benchmark study highlights the annual variances in weather patterns and individual preferences which can influence how and when strip-tillers build berms.

While the average width (8½ inches) and depth of tillage (7 inches) has been consistent thought the history of the study, there are other noteworthy differences.

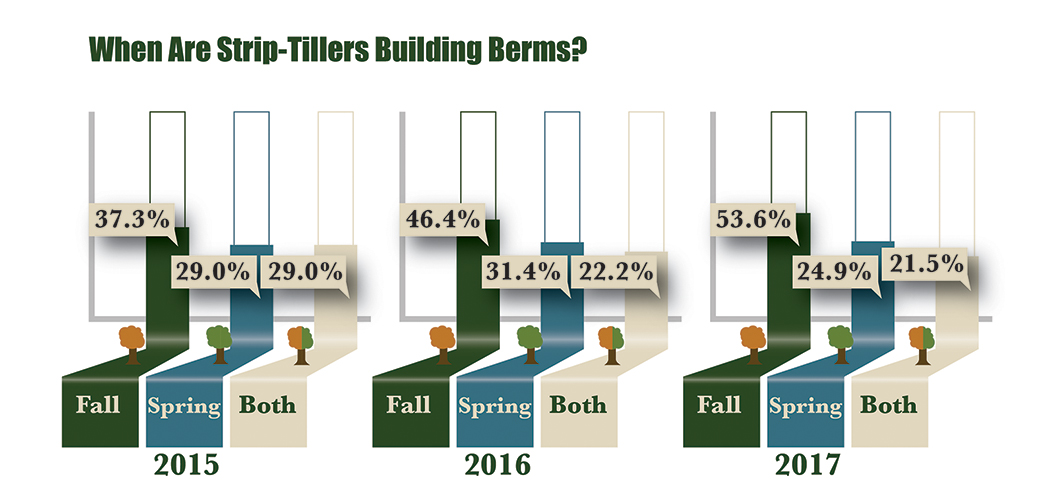

Perhaps the most noteworthy year-over-year change came in the percentage of spring strip-tillers, dropping from 31.4% in 2016 to a low of 24.9% last year. This decline followed 2 years of growth in spring strip-till, perhaps aided by more conducive conditions in North America during those years.

AUTUMN PREP. Trending upward is the percentage of strip-tillers preferring to build berms exclusively in fall, while those strip-tilling in spring and fall remained consistent, year-over-year.

For the third year in a row, the percentage of fall strip-tillers grew. For the first time, more than half of respondents — 53.6% — chose the post-harvest window to build berms. This marks nearly a 7-point increase over 2016 (46.4%) and a 16-point jump over 2015 (37.3%).

While the majority prefer fall strip-till, only 14.3% of respondents said they refresh strips in the spring, although 67.7% said they sometimes will refresh strips. These totals are consistent with the last 3 years…